Portugal Golden Visa

The Portugal Golden Visa invites applicants to enjoy a dynamic and accelerating economy with competitive markets, as well as a fantastic place to live.

What's on this page

- What Is the Golden Visa Programme?

- The Impact of the Golden Visa on the Portuguese Economy

- Investment Opportunities

- Discover Investment Funds for Portugal’s Golden Visa

- Why Apply for the Portugal Golden Visa Programme

- What Are the Benefits of the Portuguese Golden Visa?

- What Are the Requirements for Portugal's Golden Visa?

- Portugal Golden Visa Application Process

- Portugal Golden Visa Renewal Process

- Timeline of the Portuguese Golden Visa Programme in 2024 (Infographic)

- Navigating the Portugal Golden Visa Application Process

- Portugal Golden Visa Costs

- What Are Portugal’s Golden Visa Tax Implications?

- Latest News and Insights

- Belion: How We Can Help You

What Is the Golden Visa Programme?

The Golden Visa Programme is a residency-by-investment initiative designed to attract foreign investment to Portugal. Launched in 2012, this programme enables non-EU citizens to secure residency permits in Portugal by making qualifying investments. These investments can be in various forms, including capital transfers, business creation, or supporting Portuguese cultural and scientific research.

The programme is designed to provide an efficient route to residency and potential citizenship for foreign investors while simultaneously benefiting the Portuguese economy.

The Impact of the Golden Visa on the Portuguese Economy

The Golden Visa programme has played, and continues to play, a positive role in the Portuguese economy, now more than ever. By facilitating foreign investment, the programme injects capital into the Portuguese economy, an essential component for sustained economic growth.

In addition to capital gains, the Portuguese economy benefits from international entrepreneurs who establish their businesses in Portugal. This not only fosters job creation but also introduces innovative and fresh ideas, a critical element contributing to the development and modernisation of the country's corporate landscape.

It is also important to consider the long-term impacts of this programme on the Portuguese economy. Since it is a residency programme, holders usually want to establish their lives in a new country, meaning their investments tend to be continuous and larger than the initial one.

In a study conducted by PWC in 2022, golden visa holders were found to contribute about six times the value of their initial investment within five years, as stated by EuroNews. This highlights the substantial long-term economic benefits of the programme.

There have been unintended consequences of the Golden Visa programme on the Portuguese economy. Portugal has been experiencing a housing crisis for some years. One of the previous paths to invest in the Portuguese Golden Visa was through real estate acquisition, which had become the most popular method for obtaining a residence permit.

It is not the fault of the Golden Visa programme that Portugal experienced a housing crisis, but it did impact house price inflation in Portugal by increasing demand in the Portuguese real estate market. To mitigate and respond appropriately to this problem, the Portuguese government ended the real estate acquisition route for obtaining the Golden Visa in October 2023.

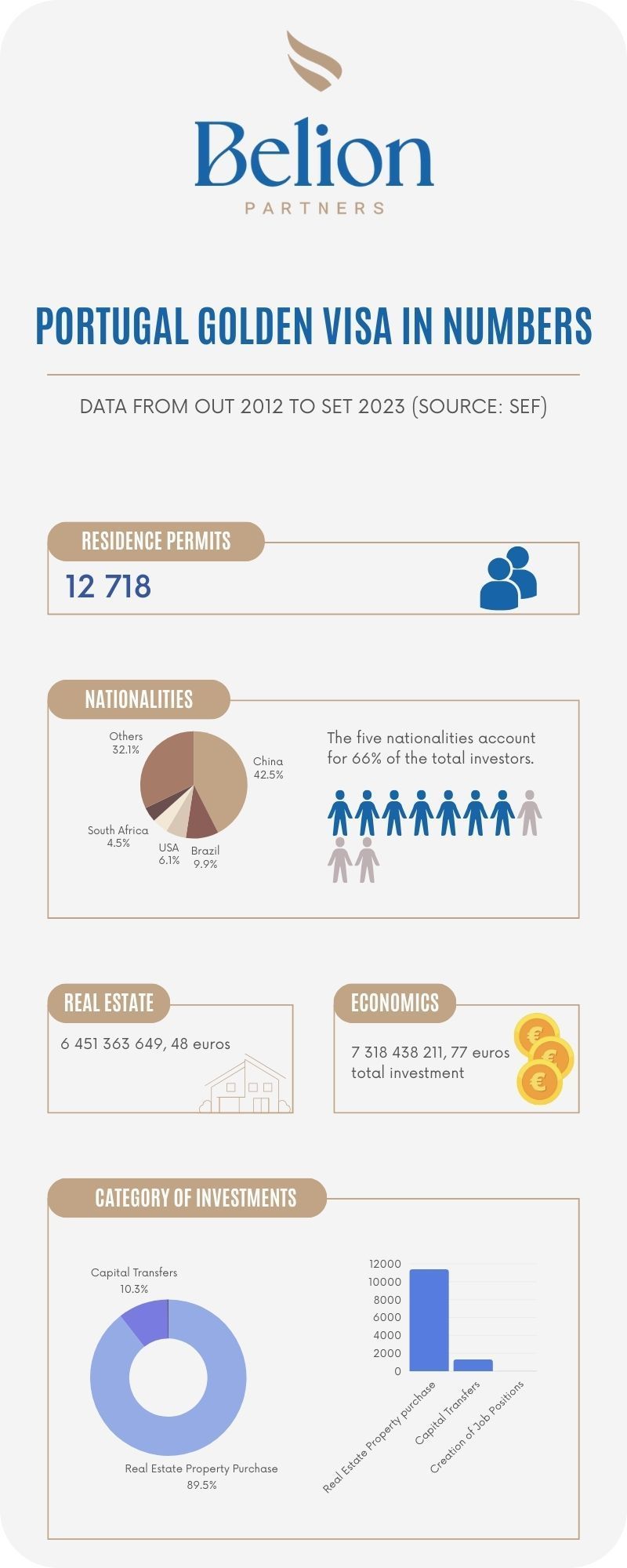

Golden Visa in Numbers

To better visualise the impact of the Golden Visa on the Portuguese economy, let us review available data from SEF, now AIMA, over the 12 years of the Golden Visa’s existence in Portugal. It is important to note that the data provided by SEF corresponds to the period from October 2012 to September 2023, when SEF was abolished. This data reflects the landscape before significant changes were made to this programme.

The total investment in Portugal reached an impressive 7,318,438,201.77 euros, encompassing all eligible forms of investment available under the Golden Visa programme, during the period mentioned.

When categorising the types of investments, real estate purchases account for 6,451,363,649.48 euros, representing 88% of the total capital invested in Portugal through the Golden Visa programme. This segment consists of 11 383 residence permits.

Another prominent investment avenue is capital funds, which have also become a preferred choice among investors. This path for obtaining Portuguese residency has generated 260,812,057.45 euros through 723 residence permits, making it the most prevalent method for Golden Visa investments at present.

On the demographic side, 12 718 residency permits were issued under the Golden Visa programme up until October 2023. The top five nationalities leading these applications were:

- China – 5 366 holders

- Brazil – 1 229 holders

- USA – 713 holders

- Türkiye – 592 holders

- South Africa – 550 holders

Collectively, these five nationalities account for approximately 66% of all individuals who sought residency permits through the Golden Visa programme, nearing two-thirds of the total. Additionally, 20 424 residence permits were issued to family members of the primary applicants under family reunification rules.

The third and final category of investments, alongside real estate and capital transfers (capital funds being one of the branches of this category; to know the other branches, go to the section ‘Investment Opportunities’), is job creation. Notably, there were 23 resident permits that resulted in the establishment of at least 10 job positions each.

Statistics on Portugal’s Golden Visa Programme

Investment Opportunities

For the purpose of obtaining a Golden Visa, there are numerous investment options available. Including:

- Donations to Portuguese arts and culture

- Scientific research activities

- Golden Visa investment funds

- Incorporation of a commercial company

- Creation of 10 new permanent jobs

Donations to Portuguese Arts and Culture

One option is capital transfers of 250,000 euros or more to support artistic production, recovery, and maintenance of national cultural heritage through various public and private entities. If the artistic or cultural project is located in a low-density area, the required investment decreases to 200,000 euros.

Scientific Research Activities

Another option requires capital transfers of 500,000 euros or more for research activities conducted by public or private scientific institutions within the national scientific and technological system.

Golden Visa Investment Funds

For this type of investment, investors can transfer a minimum of 500,000 euros to acquire participation units in investment funds or venture capital funds focused on the capitalisation of companies, provided these funds are constituted under Portuguese legislation, have a maturity of at least five years, and at least 60% of the investment value is made in commercial companies based in Portugal.

Incorporation of a Commercial Company

Investors can transfer a minimum of 500,000 euros for the incorporation of a commercial company with headquarters in Portugal, combined with the creation of five permanent jobs, or to increase the share capital of an existing company with the creation of five permanent jobs or maintenance of 10 permanent jobs for at least three years.

Creation of 10 New Permanent Jobs

There is also an opportunity to invest in a business in the format of a single-member private limited company without a minimum investment requirement, provided the business creates and maintains at least 10 new permanent jobs in Portugal, which is reduced to more than eight jobs if located in a “low-density area.”

Investment Types No Longer Available for the Portuguese Golden Visa

The Portuguese Golden Visa programme has evolved over time to remain relevant and contribute positively to Portugal’s economy. It is important to note that investments in real estate are no longer available as of October 2023.

Key Information About Investment Requirements for the Portuguese Golden Visa

Investments cannot be made directly or indirectly in real estate and must be maintained for the entire duration of the Golden Visa. If an investment is replaced, the new investment must be of the same type and the old investment can only be disposed of after the latest investment is made.

What Are Low-Density Areas?

Low-density areas in Portugal are defined as regions with fewer than 100 inhabitants per square kilometre or a per capita GDP below 75% of the national average. This encompasses most of Portugal, excluding the coastal regions south of the River Lima and north of the River Sado, as well as the islands of Madeira and the Azores.

Please get in touch with us if a detailed map of these low-density areas is needed.

Discover Investment Funds for Portugal’s Golden Visa

One of the most compelling options available to investors pursuing the Portuguese Golden Visa is undoubtedly the array of investment funds tailored for this purpose.

According to current Portuguese legislation on this matter, as outlined in Law No. 23/2007 of July 4th, Article 3, Number 1, Subparagraph VII, which was revoked by Law No. 56/2023, Article 44, Number 1, Subparagraph VII, the following was stated:

- A capital transfer of 500,000 euros or more must be made for the acquisition of units in investment funds or venture capital funds aimed at the capitalisation of companies established under Portuguese law. These funds must have a maturity of at least five years at the time of investment, and at least 60% of the investment directed towards commercial companies based in Portuguese territory.

Upon reviewing all current legislation, several key conditions must be satisfied to qualify for the Golden Visa through the investment fund route. These conditions are:

- The fund must not, either directly or indirectly, invest in real estate; otherwise, it will be ineligible for Golden Visa purposes.

- The investor is required to capitalise a minimum amount of 500,000 euros.

- The investment must be maintained throughout the duration of the Golden Visa process.

- At least 60% of the fund must be allocated to companies that have their headquarters within Portuguese territory.

- The funds must be approved and regulated by the CMVM (Portuguese Securities Market Commission), which is the authority responsible for supervising and regulating the financial instruments market and ensuring investor protection.

When the conditions are met, the investor can engage in a reliable investment and could greatly benefit from the money invested. Recognising this path as the most sought-after investment to obtain the Portuguese Golden Visa, Belion Partners has developed a dedicated partnership policy to provide investors or Golden Visa applicants with a diverse array of eligible and advantageous investment options.

With this, and with our expertise in the Portuguese market, we aim to streamline the research process and connect potential investors with the appropriate management entities. If you are looking for an investment fund or want more information regarding them,

contact us; we will be delighted to offer you, our help.

Why Golden Visa Funds Are a Good Investment?

Golden Visa funds, as regulated by CMVM as mentioned above, offer investors a high level of protection and transparency by ensuring strict compliance with financial regulations. This structure guarantees a secure and monitored environment for investment.

One of the most attractive advantages is the tax exemption on Golden Visa funds. Investors benefit from tax-free profits, income, and capital gains. This means they retain 100% of both income and capital gains, as well as their initial investment of 500,000 euros without being subject to taxes.

Golden Visa funds also offer a broad range of potential earnings. While returns can vary depending on the fund’s strategy, historical performance has shown the possibility of returns as high as 25% annually. It is important to note, however, that past performance does not guarantee future results, but it serves as an indicator of potential.

The diversification of investments within Golden Visa funds—across various companies and sectors—helps mitigate risks, adding another layer of security and potential earnings to the investment.

Why Apply for the Portugal Golden Visa Programme

Free Circulation

Permanent free entry and circulation in the Schengen Space, comprising 26 European countries.

Option to Live in Portugal

Freedom to live and/or work in Portugal, while keeping another residence (if so wished) in another country.

Tax Benefits

Option to become a

non-habitual resident of Portugal for tax purposes, thereby paying little or no tax for 10 years.

Permanent Residency

Option to obtain permanent resident status after 5 years of having made the initial investment.

Citizenship

Option to acquire Portuguese citizenship after 5 years of having made the initial investment.

Extensible to Family

The benefits are extensible to the investor’s family, including spouse or partners and dependents.

Flexible Investment

Flexible and affordable investment options starting at 200,000 euros

Stay Requirements

Minimal stay requirements (14 days, consecutive or not, per 2-year period).

What Are the Benefits of the Portuguese Golden Visa?

The Portuguese Golden Visa offers numerous benefits to its holders. To raise awareness, some of these benefits are highlighted below:

Citizenship and Residency

The Portuguese passport is one of the most desirable in the world. After holding the Golden Visa for five years, one can apply for Portuguese citizenship, provided specific criteria are met, such as passing a basic Portuguese language test. Once citizenship is granted, the individual becomes eligible for a Portuguese passport.

Travel Mobility Under the Portuguese Passport

The Portuguese passport grants visa-free travel to 172 countries and full European Union citizenship, enabling applicants to live, work, and study in any EU member state. Additionally, the visa extends to immediate family members, including spouses, children, and dependent parents through family reunification regulations.

Short-Stay Requirements

One of its most appealing features is the low minimum stay requirement. Visa holders are only required to spend seven days per year in the country, making it an excellent option for investors seeking flexibility and for those who do not want to relocate permanently.

Portugal’s healthcare system is known for its high quality and accessibility, ensuring individuals and families receive excellent medical care. In Portugal, all legal residents have access to the national healthcare system, which is primarily free for both citizens and legal residents. This extends to expats who obtain legal residency, allowing benefits from public healthcare services. Residents with a Portuguese Golden Visa or D7 Visa are also eligible for access to Portugal’s public healthcare system regardless of any pre-existing medical conditions or age.

The Golden Visa permits both applicants and family members to live and study in Portugal. Access to high-quality education in a safe and stable environment is a significant benefit for families considering relocation. Enrolling in the Portuguese Education System is an excellent way of fully integrating children into Portuguese culture while also offering them a top-tier education.

Children can be enrolled in state schools following the Portuguese curriculum or in one of many private British and American international schools in Portugal.

Golden Visa applicants can extend their Portuguese Golden Visa to family members under the family reunification rules, allowing them to obtain residence permits as well.

Eligible family members include:

- Spouse or partner of the main applicant.

- Minor, those under 18 years old, dependent incapable children, or children over 18 years old who are unmarried and enrolled as full-time students, no under 25 years old.

- Dependent parents of both the main applicant and spouse/partner.

One of the key motivations for individuals relocating to a new country and establishing long-term roots is the guarantee of safety.

Safety is a fundamental human need, as recognised in Maslow's hierarchy of needs pyramid and a priority for anyone seeking stability. Fortunately, Portugal provides a secure environment for its residents.

According to the latest data from the Institute for Economics and Peace, Portugal ranks as the 7th most peaceful country globally in the 2024 Global Peace Index (GPI). Notably, Portugal is the only nation in Southern Europe to feature in the top ten, with Spain, the next highest in the region, ranking 23rd.

Portugal is widely recognised for presenting a high quality of life at a relatively affordable cost, particularly when compared to other Western European countries.

Portugal has much more to offer besides its affordability, but it is certainly one of the main reasons why Portugal has become a popular destination for both visitors and those looking to relocate.

When comparing the cost of living in Portugal to countries like the US or the UK, Portugal stands out as significantly more affordable without sacrificing residents' quality of life. It provides access to excellent services, rich cultural experiences, and diverse leisure activities.

Of course, individual lifestyle choices play a role in determining living expenses. That’s why it is essential to plan a budget while still enjoying the excellent lifestyle options this remarkable country has to offer.

Portugal, with its expanding economy, offers a range of tax regimes which are attractive to foreign investors. Understanding the concept of “tax residence” is crucial when exploring these benefits. An individual is generally considered a tax resident in Portugal if they stay 183 days (consecutive or not) within a 12-month period. Additionally, owning a home in Portugal, under the condition that it is intended to be a habitual residence can also qualify an individual as a tax resident, even if they do not meet the 183-day requirement.

One of the primary benefits for new residents is the Non-Habitual Resident (NHR) Tax Regime, which is valid for 10 years. The NHR offers substantial tax benefits, including no tax on self-employed income and dividends, no tax on foreign-sourced income, a 10% tax on pension payments from abroad, and a 20% tax on income earned in Portugal. It's important to note that as of 2024, the NHR regime remains available only under specific conditions and is set to finish at the end of 2024.

Additionally, the Tax Incentive for Scientific Research and Innovation (IFICI+), introduced at the beginning of 2024, offers a single tax rate of 20% on income from employment or self-employment earned within eligible activities. This incentive is also valid for 10 consecutive years and aims to further attract professionals involved in scientific research and innovation to Portugal. These tax benefits make Portugal an attractive destination for foreign investors and skilled professionals seeking favourable tax conditions.

These tax benefits make Portugal an attractive destination for foreign investors and skilled professionals seeking favourable tax conditions. Contact us to learn more about Portugal’s tax landscape.

Pleasant Weather

Despite its relatively small size, Portugal's diverse geography, varied topography, and extensive coastline contribute to a wide range of climatic conditions, depending on the specific location and region of the country.

First, it is important to be aware that Portugal is one of the European countries with the most sun time, with an average of 2 500-3 200 hours annually.

Secondly, Portugal is characterised by distinct climatic zones: a maritime temperate climate in the north and a Mediterranean climate throughout most of the country. The southern region tends to be slightly warmer than the rest. Regarding insular Portugal, the Azores and Madeira archipelagos experience a temperate climate.

With its pleasant climate and abundant sunshine, Portugal invites everyone to explore its streets, enjoy outdoor activities, and discover its natural wonders.

Rich Culture and Natural Wonders

Portugal is renowned for its natural beauty and deep-rooted cultural heritage. Its rich traditions are evident throughout the country, in its cuisine, architectural structures, traditional music and so much more. Even in the language, the ancient strong culture is palpable. The Portuguese language, often referred to as the ‘language of Camões’ in honour of the famed poet Luís Vaz de Camões, who immortalised the nation’s bravery and nobility in his epic poem Lusíadas, further underscores Portugal’s vibrant cultural identity.

Portugal's rich cultural heritage has been recognised by UNESCO, with 17 sites earning the prestigious World Heritage distinction so far. Of these, 16 are cultural landmarks and one is a natural wonder. Notable examples include the Alto Douro wine region, the Évora historical city centre, and the Laurisilva of Madeira, each representing a unique aspect of Portugal’s exceptional legacy.

Nature's beauty graces every region of Portugal, from the north to the south, from inland regions to the coastal stretches, and across the islands. Every corner has something extraordinary to offer. From the imposing Serra da Estrela mountains to the stunning beaches of the Algarve, the breathtaking beauty of Peneda-Gerês National Park—a UNESCO biosphere reserve—is awe-inspiring.

On the islands of the Azores, the pristine landscapes are barely touched by human hands, offering splendid vistas of the Atlantic Ocean, where you can see dolphins and sperm whales. Portugal's natural beauty is truly unparalleled.

With this short description, Portugal is a country of diverse wonders, where one can discover new delights every day. Its rich cultural heritage and stunning natural landscapes offer endless opportunities for exploration and appreciation.

Contact us if you are interested in learning more about Portugal.

What Are the Requirements for Portugal's Golden Visa?

The Portuguese Golden Visa is renowned for its minimal requirements, making it one of the most accessible Golden Visa programmes worldwide, especially due to its lenient minimum stay requirements.

Portugal’s Golden Visa Minimum Residence Requirements

The Golden Visa requires a minimum stay of just 7 days per year, totalling 14 days every two years, coinciding with the visa renewal period. This is among the lowest residency requirements in global Golden Visa programmes.

This feature offers a distinct advantage for individuals who prioritise flexibility, such as business professionals,

retirees, and

digital nomads. These groups often require or prefer the ability to move frequently. With this unique feature among global Golden Visa Programmes, holders of the Portuguese Golden Visa can relocate without losing their resident status.

Make and Maintain a Qualified Investment

As a residence-by-investment programme, the Golden Visa necessitates a qualified investment, which must be maintained for the duration of the residency.

The investment can take many forms, such as a donation to the Portuguese arts, the relocation of a company to Portuguese territory, or investment in a Portuguese fund, which is the most popular option. We cover the qualified types of investment in the section ‘Investment Opportunities’.

If the most appealing investment is the Portuguese funds available for Golden Visa purposes, learn more by reading the section “Discover Investment Funds for Portugal’s Golden Visa”.

Documents Required for the Golden Visa Application

Applicants must submit the following documents for both the initial application and subsequent renewals:

- A copy of all pages of the passport

- A Power of Attorney (POA) and an affidavit signed in the presence of a lawyer in Portugal

- Proof of the main applicant’s tax identification number from their country of origin, residence, or tax residence

- A certified copy of the criminal record or police clearance letter (e.g., FBI report for US residents) issued by the country where the applicant lived for at least one year

- Various Portuguese documents, obtained under the Power of Attorney

For family members applying under the family reunification regulations, additional documents are required:

Spouse:

- A marriage certificate or “common law spouse” certificate issued by an official entity, such as a court of law

Child:

- Birth certificate

- Proof of marital status if over 18 and under 25 years old

- Proof of economic dependency if over 18 and under 25 years old

- Proof of enrollment as a full-time student if over 18 and under 25 years old

Dependent Parent:

- Birth certificate

- Certificate of no income issued by the tax authority of the country of origin if under 65 years old

- Dependent Applicant Over 16 Years Old:

- A certified copy of the criminal record or police clearance letter (e.g., FBI report for US residents) issued by the country where the applicant lived for at least one year

- A certified copy of the criminal record or police clearance letter (e.g., FBI report for US residents) issued by the applicant’s country of nationality, if different from the country of residence

These comprehensive but manageable requirements make Portugal’s Golden Visa an attractive option for those seeking residency in a southern European country. Contact us and see how we can guide you in this process.

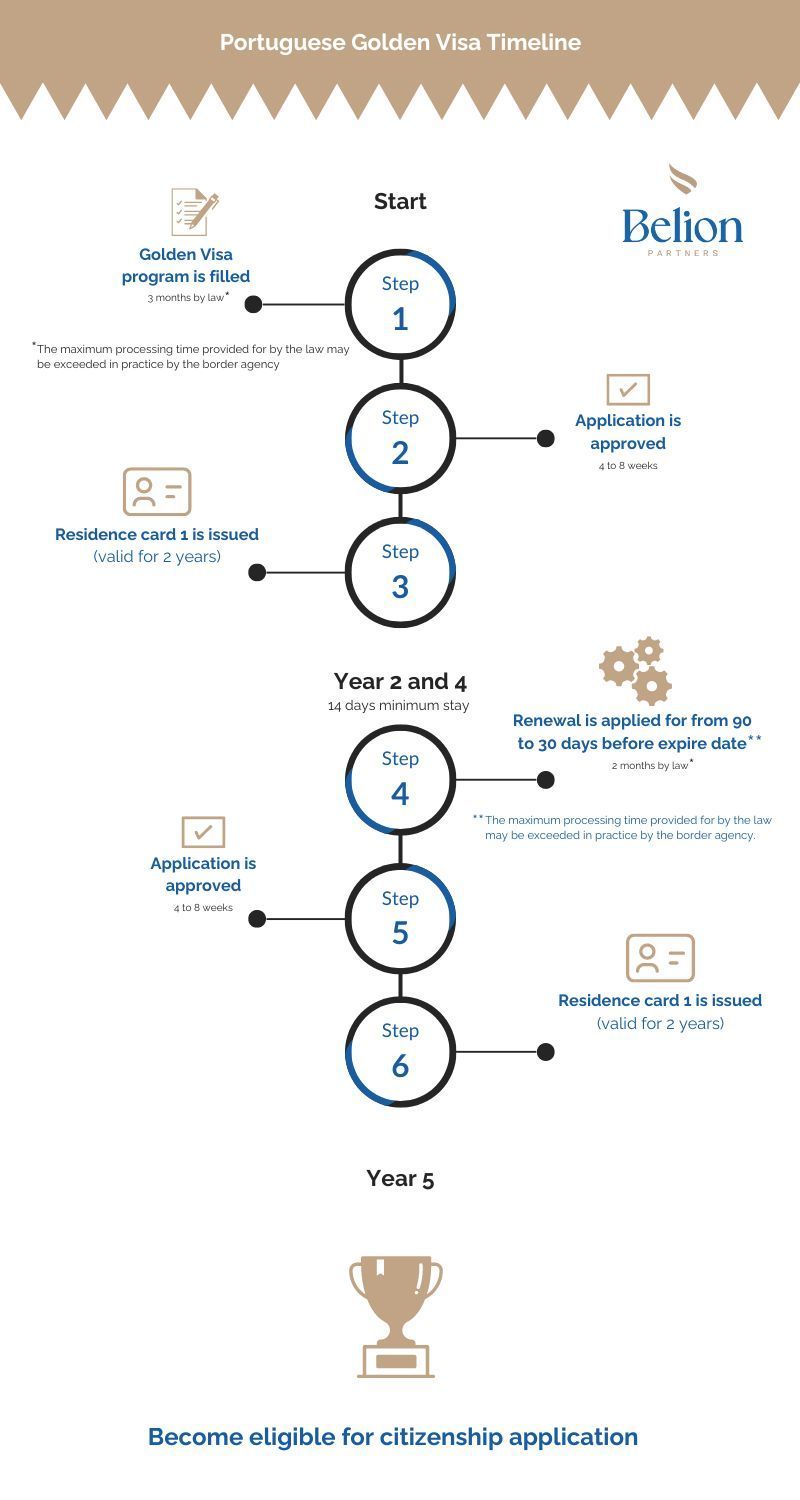

Portugal Golden Visa Application Process

Applying for the Portugal Golden Visa is straightforward if the correct steps are followed, schedules are adhered to, and necessary documentation is provided. While the process is generally simple, it involves several important steps that must be completed accurately. Any misstep could result in a delay or failure of the application. Therefore, seeking legal support is highly recommended to ensure a smooth and successful application. Additionally, some documents, such as a Power of Attorney (POA), need to be reviewed by a lawyer in Portugal.

Here’s a breakdown of the steps required to acquire residency by investment:

Step One: Choose an Investment Route

As outlined in this guide, there are multiple ways to obtain your Golden Visa through a variety of investment options. The first step is to select the investment route that aligns best with the goals and interests of the applicant. Analysing and choosing the most suitable option is crucial.

For instance, if the applicant is passionate about Portuguese culture, investing in artistic production might be the ideal choice. If the primary focus of the applicant is financial returns, investment funds could be more appropriate. Alternatively, if the applicant has a love for science and wishes to contribute to scientific progress, investing in research activities may be the best path to follow.

Step Two: Appoint a Portuguese Tax Representative and Obtain a NIF

Appointing a tax representative is legally required for residents outside the EU, EEA, or Switzerland. This representative will act on behalf of the applicant in dealings with the Tax Authority, ensuring compliance with Portuguese tax obligations and regulations. The representative will also obtain the NIF number for the applicant.

Acquiring a NIF number is essential. This number enables the acquisition of goods and services, opening bank accounts, signing contracts, and buying properties or vehicles in Portugal.

Step Three: Open a Bank Account in Portugal (Which Can Sometimes Be Done Remotely)

Opening a bank account in Portugal is crucial for managing day-to-day financial tasks. This can often be done remotely, making the process convenient for international clients. Choosing the right bank to suit specific needs is also an important consideration. Belion Partners is here to assist with this process, ensuring a smooth transition to Portugal. Contact us for expert guidance and support.

Step Four: Transfer the Required Amount from Abroad

Once a local bank account is established, the next step is to transfer the necessary funds from abroad to this account. This can be done in multiple transfers and from any non-Portuguese territory. This step is important as it facilitates the chosen investment, making it a mandatory action in the process.

Step Five: Make the Required Investment from the Investor's Portuguese Bank Account

At this stage, it's time to finalise the investment. With the chosen investment route in mind, complete the payment using the funds transferred to the Portuguese bank account.

Step Six: Submit Your Golden Visa Application Online

Now that everything is in place—including all necessary paperwork related to your investment, apostilles, translations, notifications, and documents for both the main applicant and any accompanying family members—it's time to submit the application through the AIMA (Immigration Authorities) online platform. Ensure all steps have been meticulously completed to facilitate a smooth application process and increase the chances of success.

Step Seven: Pay the Government's Initial Application Fee

After the submission of the Golden Visa application, the next step involves paying the initial governmental fees. It is important to note that these fees are subject to annual updates, typically in March. Ensuring timely payment is crucial to advancing the application efficiently.

Step Eighth: Schedule and attend the AIMA Appointment

During this step, the applicant must visit AIMA’s office in person to undergo biometric collection and submit original documents, formalising the application process. Dependent applicants, including babies, are also required to attend a biometrics-collection session, which can be scheduled separately if necessary.

Step Nine: Pay the Government Final Permit Issue Fees

Once the application is official following the AIMA’s appointment, AIMA will review and decide on the approval status. Upon approval, which is legally mandated to be processed within 90 days, the final governmental fees for the application process must be paid. These fees are subject to annual updates.

Step Ten: Collect the Residence Cards

Upon successful completion of the Golden Visa process, the applicant and, if applicable, their respective family members can collect their residence cards. These cards are the legal documents that allow residency in Portugal for a period of 2 years.

Portugal Golden Visa Renewal Process

After the First Two Years with Golden Visa, How to Proceed?

After the initial two-year period with the Golden Visa, the renewal process begins.

To proceed, renewal of the Golden Visa candidacy requires meeting the minimum stay requirements of 14 nights in Portuguese territory within each 2-year period.

It's crucial to note that scheduling the AIMA renewal appointment must be done between 90 and 30 days before the card's expiry date.

After 5 Years What Are the Possibilities for the Portuguese Golden Visa holders?

After 5 years, Portuguese Golden Visa holders have at least 3 different options to consider:

- Continuing the renewal of the Golden Visa programme every 2 years, maintaining the required investment.

- Applying for permanent residency through investment. This route requires proving proficiency in the Portuguese language and does not impose minimum stay requirements. However, whether the Golden Visa investment needs to be maintained remains unclear since this is a recent route.

- Applying for Portuguese citizenship, granting the Golden Visa holder and, if applicable, their family members full Portuguese citizenship rights.

Knowing what to do on the second renewal of the Golden Visa programme is a difficult choice and certainly calls for thought and a lot of reflection. Legal and financial advice are important when we face lifelong decisions. If you want advice in this regard, you can

contact us; we are here to guide you through the process.

Timeline of the Portuguese Golden Visa Programme in 2024 (Infographic)

How to Acquire the Portuguese NIF Number?

Obtaining the Portuguese NIF (Número de Identificação Fiscal) is key for daily life activities. This personal identification number is required for signing contracts, opening bank accounts, and conducting transactions for goods and service es. The NIF is integrated into the citizen’s card.

At Belion Partners, we recognise the significance of securing your NIF number. Feel free to

contact us to facilitate the process of obtaining your NIF number.

How to Open a Portuguese Bank Account?

Opening a Portuguese bank account is necessary for managing everyday financial matters in Portugal. Handling tasks like bill payments, wage receipts, purchases, and investment management become secure and convenient with a bank account. Whether one is a resident or a visitor, reliable access to banking services simplifies life and supports financial objectives. Remote bank account opening is available, emphasising the importance of selecting a bank that aligns with specific needs.

Real estate plays a crucial role when considering a move to another country. With the Portuguese Golden Visa programme requiring just 14 days every 2 years, relocating to Portugal is optional.

However, for those keen to embrace all that Portugal has to offer, choosing an appropriate property is a priority. With a vast array of property options in Portugal, it can be complicated to choose the one that best suits different needs and lifestyles.

Belion Partners possesses extensive expertise in the Portuguese real estate market. With our ample knowledge, we can find the ideal home for you.

Contact us to learn more about your options and find your perfect home in Portugal.

Portugal Golden Visa Costs

Portugal's Golden Visa incurs various governmental fees in addition to the minimum investment requirement. Here's a breakdown of the Portuguese government fees associated with the Golden Visa process:

For the initial resident permit, the main applicant's processing fees amount to 773.73 euros. Upon approval of the Golden Visa, the main applicant is required to pay 7,730.11 euros. These fees apply equally to each accompanying family member.

During the renewal process, which occurs every two years following initial approval, the main applicant and each family member accompanying them are subject to processing fees of 773.73 euros. The approval fee for the main applicant and each family member under family reunification regulations is 3,865.79 euros.

Please note: Governmental fees for the Golden Visa are subject to annual updates, typically occurring in March.

In addition to the governmental fees, it's crucial to consider legal fees when applying for the Golden Visa. Legal expertise is vital to certify all documents and navigate the immigration process efficiently, ensuring adherence to legal procedures and optimising the likelihood of success.

Our team is well-versed in Portuguese immigration processes and can provide tailored legal advice. Feel free to reach out to us for guidance on this matter.

Portugal Golden Visa: Pathway to Citizenship

After residing legally in Portugal for 5 years under the Golden Visa regime, holders become eligible to apply for Portuguese citizenship, as previously mentioned.

Portuguese citizenship offers numerous advantages. Living in a democratic and inclusive country is among them. With a Portuguese passport, it is possible to travel visa-free to 174 destinations worldwide and the right to live, study, and work throughout the European Union.

To obtain Portuguese citizenship, applicants must pass a Portuguese language test demonstrating at least an A2 level according to the EU framework, evaluated through the CIPLE exam. Alternatively, completing a 150-hour Portuguese language course accredited by a school or centre in Portugal or another Portuguese-speaking country is acceptable. If you require assistance with this process, please do not hesitate to contact us.

Additionally, a clean criminal record is required.

Portuguese citizenship allows for dual citizenship without requiring applicants to give up their original citizenship, but they must verify if their country of origin also permits dual citizenship.

What Are Portugal’s Golden Visa Tax Implications?

To be aware of the tax implications as a Golden Visa holder, it is essential to understand that being a legal resident does not automatically mean being a tax resident, as the two have distinct implications. Understanding this difference is key to managing residency and tax obligations effectively.

A Portuguese Golden Visa holder is considered a legal resident of Portugal; however, this does not automatically make them a Portuguese tax resident. The criteria for tax residency are different from those for legal residency.

Clarifying the concepts: Legal residents are individuals registered with immigration authorities. In Portugal, this is handled by the AIMA agency (Agência para a Integração, Migrações e Asilo).

Tax residency determines where taxpayers are obligated to report their worldwide income. In Portugal, a person is considered a tax resident if they stay for 183 days or more within a year. Additionally, having a registered tax address in Portugal is required to establish tax residency.

As a foreign national, becoming a tax resident in Portugal offers several advantages. The key benefits include access to the Non-Habitual Resident (NHR) Tax Regime (applicable under specific conditions) or the recently introduced IFICI+ programme (Incentivo Fiscal à Investigação Científica e Inovação).

Non-Habitual Resident (NHR) Tax Regime

The Non-Habitual Resident (NHR) Tax Regime was phased out in 2023, though it remains available under specific conditions until the end of 2024. This regime was designed to attract foreign investors, professionals, and retirees, aiming to stimulate the Portuguese economy and strengthen its global competitiveness.

Following the end of the NHR regime, the Portuguese government introduced the IFICI+ programme. This new tax benefit is focused on attracting a wider range of skilled individuals and businesses to Portugal, continuing the effort to drive economic growth and innovation.

IFICI+

The IFICI+ programme was established primarily for individuals seeking to relocate to Portugal for business or employment purposes, with the intent to establish residency.

The IFICI+ programme offers tax residents a flat 20% income tax rate, applicable to both dependent and independent work-related income, for a consecutive and non-extendable period of 10 years.

If you would like to learn more about this tax benefit, please

contact us. We are here to assist you and provide expert advice on the best options for managing your tax matters in Portugal.

Latest News and Insights

How Can Belion Assist with Obtaining a Portugal Golden Visa Permit?

At Belion Partners, we help individuals, families and businesses looking to establish themselves in a stable EU location, acquire a Golden Visa Portugal. If you are a prospective applicant or would like to explore your options to obtaining a residency in Portugal, get in touch with a member of our expert team. We are equipped to assist you or connect you with relevant parties for making your initial investment, also.

Have a question? Contact us

We will respond by email within no longer than one working day.