NHR 2.0: IFICI+

The IFICI+ Tax Benefit exclusively covers employment and self-employment income from activities related to science and technology, research and development, entrepreneurship, start-ups, and sectors fundamental to the Portuguese economy.

What's on this page

- The Old NHR Tax Benefit Programme

- The “New NHR”: Fiscal Incentive for Scientific Research and Innovation (IFICI+)

- What Are the Benefits of the IFICI+?

- What Are the Eligibility Criteria for IFICI+?

- Differences Between the Old NHR and the IFICI+?

- IFICI+ Application Process

- How UK Citizens Can Benefit from The IFICI+ Tax Benefit

- How US Citizens Can Benefit from The IFICI+ Tax Benefit

- What Are the Minimum Stay Requirements?

- Costs of the IFICI+

- Belion: How We Can Help You

The Old NHR Tax Regime Programme and Its Transitional Period

Introduced in 2009, Portugal’s Non-Habitual Residence (NHR) regime allowed eligible individuals to become tax residents in Portugal while benefiting from reduced or exempted taxes on certain categories of income for up to 10 years. The NHR was particularly appealing to expats, retirees, skilled professionals and people living from passive income seeking favourable tax conditions.

However, in October 2023, the Portuguese government announced the termination of the NHR regime, effective January 2024. This shift marks the end of an era that has provided substantial tax advantages to thousands of expatriates living in Portugal. As the NHR programme is phased out, the window for new applications is rapidly closing, and those still interested must act quickly to meet urgent deadlines.

Under specific conditions, applications remain possible until 31 March 2025. Details on these conditions can be found on

Portugal’s Non-Habitual Resident (NHR) Tax Regime page.

The “New NHR”: Fiscal Incentive for Scientific Research and Innovation (IFICI+)

The new tax landscape in Portugal is defined by the Fiscal Incentive for Scientific Research and Innovation (IFICI+) programme, designed for highly qualified professionals moving to Portugal for residence and employment. Under this updated tax regime, individuals benefit from a special 20% Personal Income Tax rate on income from either dependent or independent work for a non-renewable period of 10 years.

The IFICI+ Tax Benefit exclusively covers employment and self-employment income from activities related to scientific and technologic research and development, which will now be taxed at a rate of 20% for non-residents moving to Portugal, provided they have not been resident in Portugal for the last five years and are not currently benefiting from the “old” NHR .

Eligibility Criteria for the IFICI+ Tax Benefit Programme

To qualify for the new regime, applicants must meet the following conditions:

- They must become tax residents in Portugal.

- They must not have been tax residents in Portugal during the previous five years.

- They must earn income in specific professional categories.

Regarding professional categories, here is the transcription of professional activities that fall within the scope of paragraphs a) to f) of number 1 of Article 58-A of the Estatuto dos Benefícios Fiscais (EBF) – Tax Benefits Statute. These constitute the professional categories eligible to benefit from the IFICI+ tax benefit.

- People lecturing in higher education and scientific research, along with participating in scientific roles within the national science and technology system. This includes employment opportunities within entities, structures, and networks, as well as positions and memberships in governing bodies within organisations recognised as technology and innovation centres.

- Skilled positions within the context of contractual benefits aimed at promoting productive investment according to the Tax Law.

- Individuals with jobs recognised by the Agency for Investment and Foreign Trade of Portugal, E.P.E., or by IAPMEI - Agency for Competitiveness and Innovation, I.P. as fundamental to the national economy (including those working in the Azores and Madeira, subject to conditions set by regional laws).

- Individuals engaged in research and development activities, whose expenses are eligible for the purposes of the tax incentive system in research and business development, as outlined in the Investment Tax Code.

- Individuals moving to Portugal to work for certified start-ups (companies with a staff of no more than 250 individuals, an annual income not exceeding 50 million euros and a business history of fewer than ten years), provided that the company’s headquarters are established in Portugal or have representation in the country. Alternatively, they must have at least 25 employees in Portugal. Moreover, these startups cannot result from a merger or division of a larger company.

- Job positions or other activities carried out by tax residents in the autonomous regions of the Azores and Madeira .

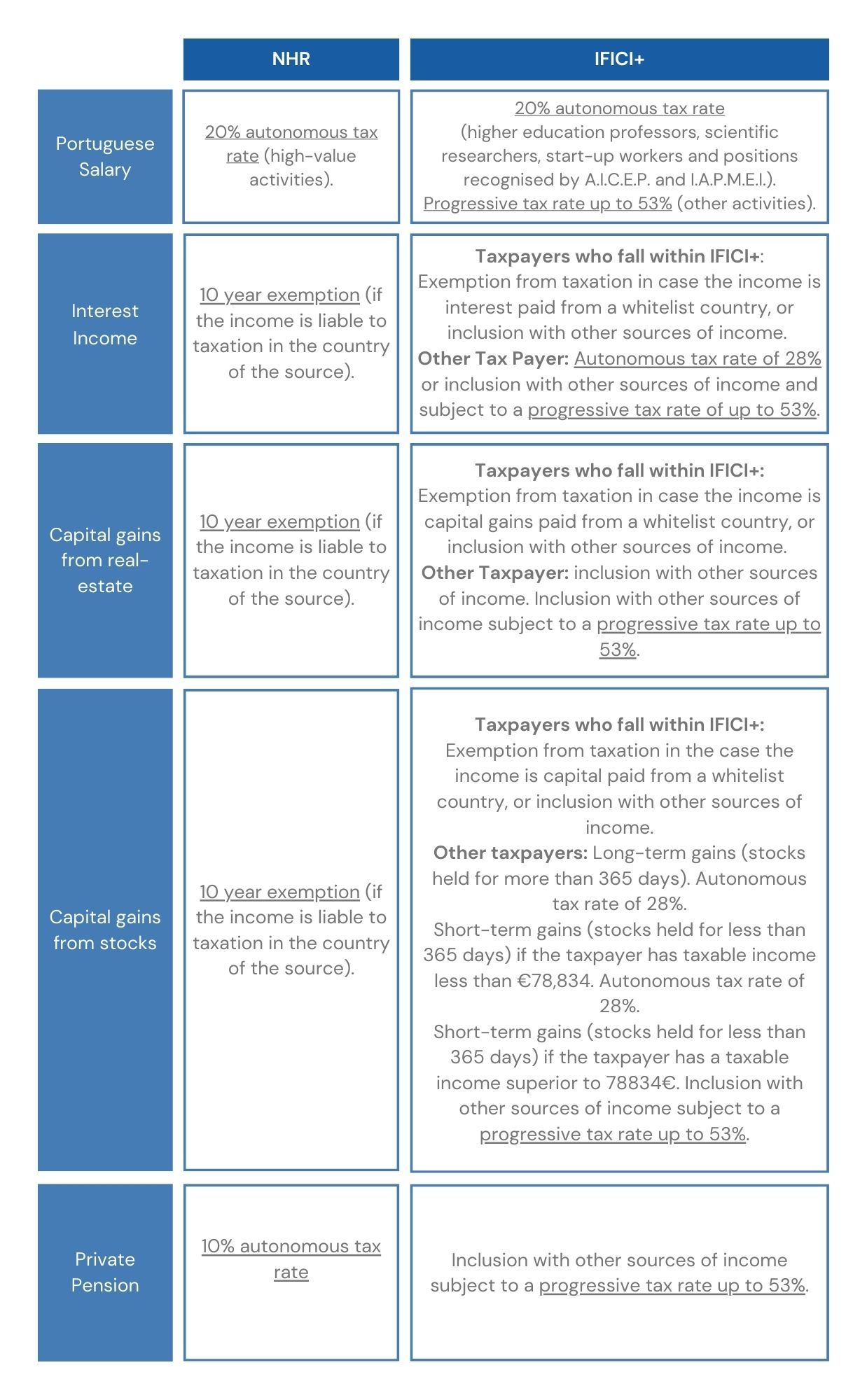

Key Differences Between the Old NHR and the New IFICI+

While the old NHR regime focused on broad tax benefits for expats, the new IFICI+ is targeted specifically at highly skilled professionals in sectors that drive scientific research, innovation, and economic growth in Portugal. This shift emphasises Portugal’s goal of attracting talent that contributes to its strategic industries, rather than providing broad tax benefits without the requirement of professional contribution.

The IFICI+ programme also introduces tighter eligibility, focusing on professionals in specific roles recognised by Portuguese investment and economic agencies, and those working within certified startup companies. The new regime retains the 20% tax rate but with an added emphasis on high-value professional activity, aligning Portugal’s tax incentives with its broader economic objectives.

Comparison of NHR vs. IFICI+ Tax Benefits

Application Process for IFICI+

To begin the application process for IFICI+, you must first prove your right to reside in Portugal. For EU, EEA, and Swiss citizens, this involves registering at their local city hall with a passport and EHIC Card. Non-EU citizens will need to obtain a residence permit, which can be acquired through various programmes such as the Golden Visa or the D7 passive income visa.

Next, obtaining a NIF (Tax Identity Number) is essential, as it is required for all legal and business activities in Portugal. Non-residents can secure a NIF through a representative, while residents can directly visit local tax offices with an ID and proof of residency.

Following this, you need to register as a tax resident in Portugal. This step is indispensable for formalising your tax status, and you may also use online simulators to gain a better understanding of your potential tax implications.

Finally, this tax benefit was formally regulated on 23 December 2024, through Regulation No. 352/2024/1. However, there is still no information available on the process for the application – the Government must inform if there will be a specific procedure for an application or if the tax benefit will be requested in the yearly tax return.

How UK Citizens Can Benefit from The IFICI+ Tax Regime

UK citizens can take advantage of Portugal’s new IFICI+ by benefiting from a reduced 20% tax rate on employment and independent work income for up to 10 years.

To qualify,

UK citizens must become tax residents, spend at least 183 days per year in Portugal, and not have been tax residents in Portugal for the previous five years. The programme is particularly advantageous for professionals in high-demand sectors such as research, IT, tourism, and agriculture, as well as those working in certified startups or companies recognised as vital to the national economy.

How US Citizens Can Benefit from The IFICI+ Tax Benefit

US citizens can benefit from Portugal’s IFICI+ regime by securing a 20% tax rate on income from qualified employment and independent work for a 10-year period.

To be eligible,

US citizens must become tax residents in Portugal, meaning they need to spend at least 183 days per year in the country or maintain a permanent residence. Applicants must not have been tax residents in Portugal during the previous five years. Despite US citizens having to report global income to the IRS, the IFICI+ regime’s benefits, along with available tax credits and the US-Portugal tax treaty, can help minimise overall tax liabilities. The regime is particularly suited for professionals in high-value sectors such as research, technology, and startups, making Portugal a compelling destination for skilled US professionals and entrepreneurs .

Minimum Stay Requirements

To qualify for the IFICI+ programme, you must reside in Portugal for at least 183 days, consecutive or non-consecutive, within a year. Applicants must also meet two basic criteria:

- The legal right to reside in Portugal (via EU/EEA/Swiss citizenship or residency).

- Non-residency for tax purposes in Portugal during the preceding five years.

Costs of the IFICI+ Tax Benefit

The IFICI+ programme offers a unique opportunity for highly skilled professionals seeking to establish themselves in Portugal. While the regime provides attractive tax incentives, it is essential to consider the detailed requirements and costs associated with relocation and establishing residency in Portugal.

If you are considering relocation to Portugal and are interested in the benefits of the new tax regime, our team is available to provide comprehensive support and guidance. If you require further information or assistance with the application process, please do not hesitate to

contact us.

How can Belion assist with obtaining Portugal's

IFICI+ Tax Benefit?

If you are considering becoming a tax resident in Portugal, you can rely on Belion to provide all the assistance you need.

Have a question? Contact us

We will respond by email within no longer than one working day.